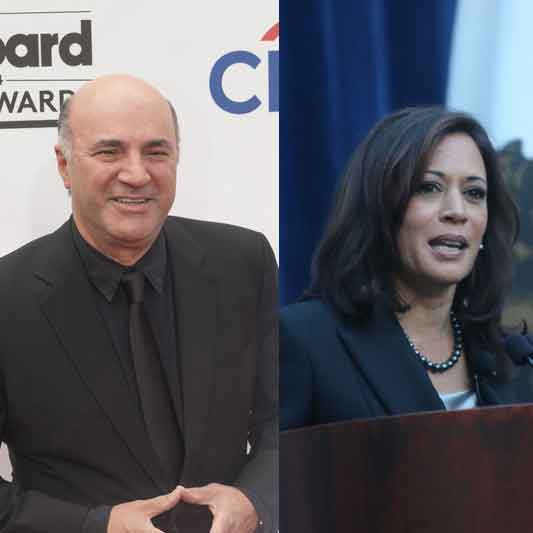

Kevin O’Leary, known as “Mr. Wonderful” from “Shark Tank,” has voiced significant concerns about Vice President Kamala Harris’ latest economic plans.

Sharing his concerns on Fox News’ “Jesse Watters Primetime” on August 19, 2024, O’Leary, a successful entrepreneur, criticized the economic initiatives proposed by the Democratic presidential candidate.

In a CNN interview, O’Leary disagreed with several parts of Harris’ plan, particularly her strategy to combat price gouging and the proposal to provide down payment assistance to first-time homebuyers. He warned these actions could have unintended negative repercussions.

Harris unveiled her economic strategy on August 16, 2024, at a rally in North Carolina. Her comprehensive plan includes various policies aimed at alleviating the financial stress on American households. Key features involve federal initiatives to control grocery price gouging, tax credits for homeowners and families with children, and a bold goal to construct three million new homes over the next four years.

O’Leary, however, doubts the efficacy of these plans. He pointed to the historical failures of similar price control strategies in other countries. His skepticism mirrors the wider debate among economists on the effectiveness of price controls in controlling inflation without causing shortages or black markets.

O’Leary also criticized Harris’ proposal to assist first-time homebuyers with a $25,000 down payment. He warned that in a tight housing market, this could drive inflation by inflating home prices. “When you give $25,000 to anybody in a constrained market, you cause inflation,” O’Leary remarked. “If there’s three houses for sale on the street and everybody bidding on it gets another $25,000, all of that attributes to the seller, and you cause the price of the house to go up because there’s no supply.”

His views align with those of other financial experts who caution that increasing demand without addressing supply constraints could result in higher housing prices. Harris’ plan to erect three million new homes aims to tackle these supply issues, but O’Leary questioned its feasibility. “[Real estate] is not controlled by a federal mandate; housing is state-by-state,” he argued. “She can do nothing to solve that problem. There’s no way she’s building 3 million houses. Which state is going to give her that mandate?”

Over the past few weeks, Harris’s economic plan has been a hot topic for its supporters and detractors alike.

Those who support Harris believe her policies could provide much-needed relief to American families, particularly those struggling with high housing costs and growing grocery prices.

Despite his criticisms, O’Leary expressed a desire for Harris to succeed should she become president.

As the debate over Harris’s economic plan continues, the implications are significant. The policies she’s proposing could have a deep impact on the U.S. economy, particularly in areas such as housing and consumer prices. However, implementing such vast changes, especially in the face of staunch opposition, is a considerable challenge.

O’Leary’s critiques highlight the wider discussion in the business and investment communities about the future course of U.S. economic policy.

More Information on Key Elements of Harris’ Economic Plan

Harris has outlined her strategy to address rising grocery prices by proposing a federal ban on price gouging at grocery stores. In a statement by her campaign, Harris distinguished between fair pricing and the excessive costs Americans have had to endure, particularly in the food and grocery sector. She pointed out that meat prices have surged even as meat processing firms reported record profits after the pandemic.

Although overall inflation dropped to 2.9 percent for the year ending in July, grocery prices have shot up by 21 percent during the Biden-Harris administration. Some view Harris’ plan as an attempt to resonate with voters worried about the administration’s handling of inflation.

Grocery stores, operating on slim profit margins of 1 to 3 percent, have expressed particular concern over Harris’ plan. While Harris has not publicly addressed these margins in her price-fixing proposal, she has criticized certain grocers for unjustly raising prices to boost profits. “A loaf of bread costs 50% more today than it did before the pandemic, and ground beef is up almost 50%,” Harris said last Friday. “Meanwhile, many big food companies are enjoying their highest profits in two decades, and while some grocery chains pass along savings, others still do not.”

Harris has also proposed the construction of three million new housing units over the next four years as part of her broader strategy to address the housing affordability crisis in the United States.

To encourage the creation of affordable housing, Harris’s plan includes the “first-ever” federal tax incentive specifically aimed at building starter homes for first-time homebuyers. This incentive is designed to make it more financially viable for developers to construct lower-cost housing.

Harris also plans to expand existing tax credits for affordable rental housing, thereby increasing the availability of reasonably priced living options for low- and middle-income families.

She also proposes to reintroduce the COVID-19-era child tax credit policies, which were $3,600 for qualifying children under age six and $3,000 for other qualifying children under age 18.

Harris’ plan also includes a $35 price cap on insulin for Medicare recipients, with a $2,000 annual out-of-pocket limit extended to all Americans, not just seniors. It suggests stricter regulations and stronger antitrust enforcement to prevent increases in consumer prices for drugs and food.